Content

That can be fine at first, but once your business starts to scale and attract investors, it’s time to make the switch to accrual basis accounting. SaaS accounting software gives companies the flexibility to meet new demands and challenges without making significant changes to their software. For organizations, their subscription price might change, especially if they want to add several new users or add additional features, but these changes can be made simply. This simplifies things for SaaS companies selling the accounting software and the businesses that purchase it. For example, instead of installing software on every device, businesses simply log in to their account on the Internet or download an application to access their SaaS accounting solution. SaaS accounting software is helping businesses drive digital transformation and be more efficient with their financial processes.

It makes sense that the revenue growth would go up on a smaller ARR base, so at least there is some rationality at the Series B vs. the Series A and Seed numbers we referenced above. Once again, we’d expect that the ARR hurdle would increase in early 2022 as the funding market may be cooling. [Numeric] think about the month-end close as a little bit less of a workflow and compliance process. And it’s a question of how do you ensure that these datasets that the accounting team is the owner of are correct, up to date, and complete — not just on an aggregated level, but also on a transaction level.

The Accounting Responsibilities for a SaaS Business

For example, if you do not provide a record to the Internal Revenue Service (IRS), it can lead to penalties. But getting started from day-one will set you on the right path for success in this quickly growing industry. saas accounting Delays have dangerous ends.” Put your SaaS accounting plan into place sooner rather than later, and you’ll set yourself up for confident financial growth rather than a complicated, low-visibility journey.

Simply put, revenue recognition determines when payment is recognized as revenue. In short, it’s not revenue until you have fulfilled your performance obligation. In other words, if you need to know whether your business is growing or not, you need to keep an eye on these KPIs. All scaling SaaS businesses need a tool which manages subscriptions & recurring billing on one hand, and streamlines finance operations on the other. Chargebee makes recognizing, reporting, and staying compliant a breeze, while managing your recurring billing seamlessly. ASC 606 defines a flexible, robust five-step framework that encompasses the revenue recognition principles across industries.

Taking Control of Your SaaS Finance & Accounting Process

Several years ago, SaaS companies have become subject to charging (or at least collecting!) sales tax in many states in a Supreeme Court ruling entitled Wayfair vs North Dakota. This is one of the most difficult recent changes that SaaS companies have to think about vis a vis their accounting. It’s important to note that most VCs only use recurring revenue growth in the calculation, ignoring non-recurring revenue or one-time earnings.

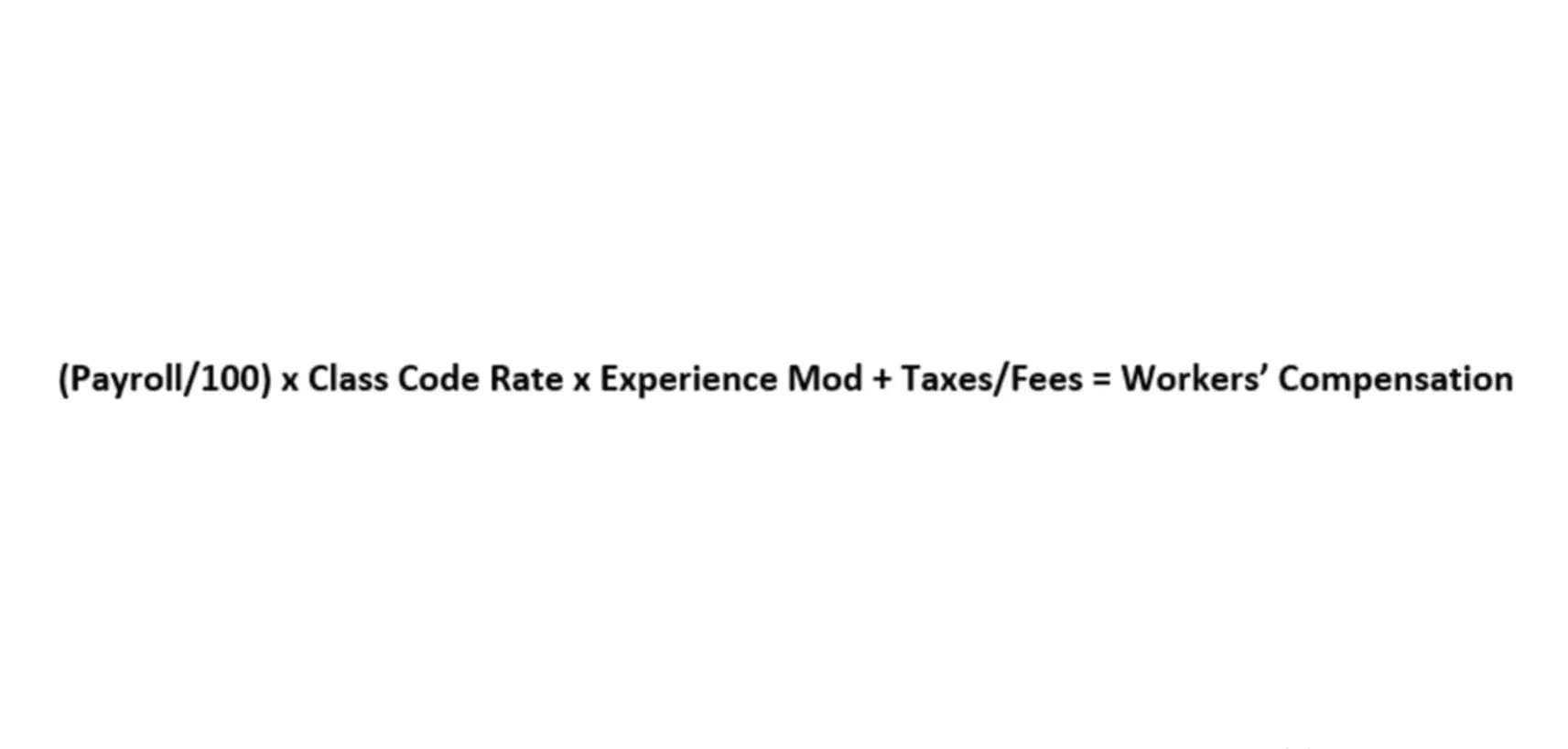

A deferred revenue account and accounts receivable are essential to keep SaaS revenue organized and easy to forecast. Revenue recognition is the accrual accounting principle that specifies how and when you can record your business’s sales and non-operating income as revenue. It requires businesses to classify pre-payments for services as liabilities (called deferred revenue or unearned revenue). Your business only earns and recognizes the payment as revenue once you’ve provided the customer with the service promised. Along with the functional benefits of good accounting, reliable accounting streamlines the process of raising venture capital funds or preparing your business for an exit.

Create a unique product to simplify accounting

A mess of calculations that don’t accurately give insight into the state of the company. If you aren’t already working with a SaaS business in some capacity, the chances are high that you will soon. As an accounting professional, it is crucial to understand the differences in managing the operations and finances of a traditional software business versus those of a SaaS business. One of the many ways in which SaaS businesses are unique is in their recurring revenue models. For SaaS businesses, it’s preferable for customers to make an up-front payment for an entire year’s worth of service. From an accounting perspective, this creates a liability that should be recorded as deferred revenue and recognized on a pro-rata basis as the contract is fulfilled.

Is GAAP very different from IFRS?

GAAP is a framework based on legal authority while IFRS is based on a principles-based approach. GAAP is more detailed and prescriptive while IFRS is more high-level and flexible.

SaaS accounting refers to recording, analyzing, and interpreting the financial information of your SaaS business. Because of the complexity of accounting in SaaS, most SaaS businesses leverage cloud SaaS accounting software to manage their financial statements and reports. The best SaaS finance and accounting software won’t just streamline operations, it will provide a wealth of data. When your F&A team interprets that data and adds context, you’re able to make strategic decisions with confidence. And, it’s why finding the right software is only part of the solution—you need a strategy that leverages those tools to drive growth.

Simplified Data Management

These entries serve as a shred of evidence for the transactions taking place in the company. Customer support is a major reason why companies often choose SaaS accounting software. SaaS software providers have a dedicated team of support specialists on standby to answer any queries users may have. SaaS accounting software programs make it easy for finance teams to share information with cross-functional teams. Users who have access to the program can be assigned various roles, thus allowing for safe data transfer.

- The key to successfully managing the finances of a subscription-based business is automation.

- If you recognize revenue before it is earned, you will misinterpret your growth numbers, which spikes your growth potential.

- SaaS billing may not be simple and may include a hybrid or other type of usage model to be considered in revenue recognition.

- We mentioned this above in the section on SaaS accounting responsibilities, but it bears repeating — set yourself up for success by maintaining a clear view of all customer contracts.

- You can find this information easily by generating detailed statements of cash flow on a regular basis, which is discussed a bit more below.

- As the leader of the business, it’s your job to weave a compelling narrative around these facts.